The Ontology community has voted, and the results are in: the ONG Tokenomics Adjustment Proposal has officially passed.

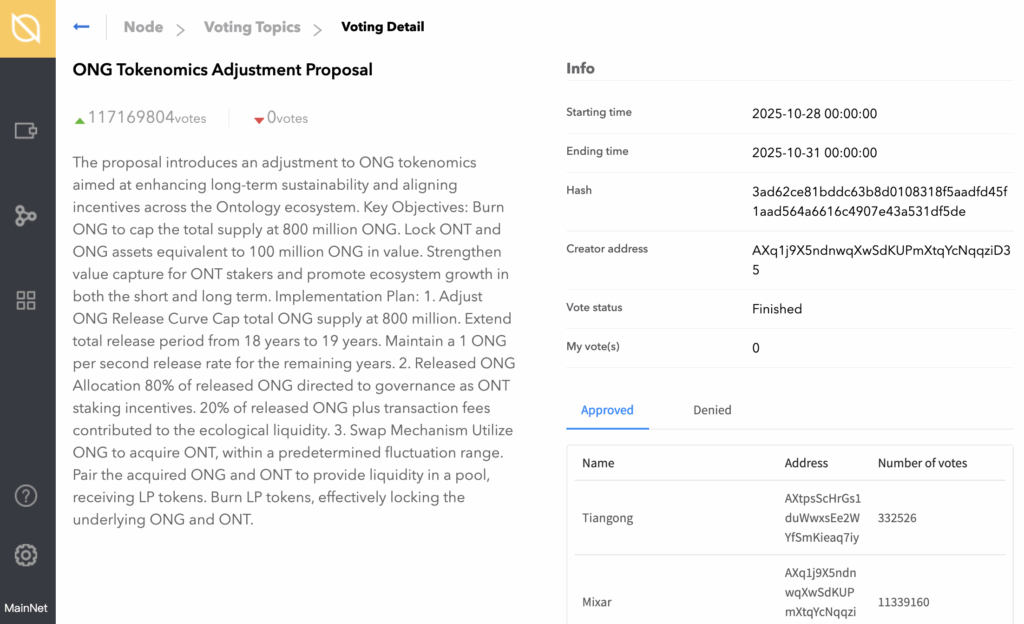

After three days of voting, from October 28 to October 31, 2025 (UTC), Ontology Triones Nodes reached a unanimous decision in favor of the proposal. The proposal secured over 117 million votes in approval, signaling strong consensus within the network to move forward with the next phase of ONG’s evolution.

A Vote for Long-Term Sustainability

This proposal represents a significant step in refining ONG’s tokenomics to ensure long-term stability, strengthen staking incentives, and promote sustainable ecosystem growth.

Here’s a quick recap of what’s changing and why it matters.

Key Objectives

- Cap total ONG supply at 800 million.

- Lock ONT and ONG equivalent to 100 million ONG in value to strengthen liquidity and reduce circulating supply.

- Rebalance incentives for ONT stakers while ensuring long-term token sustainability.

- ONG Max and Total Supply will decrease from 1 billion to 800 million, with 200 million ONG burned immediately.

- ONG Circulating Supply remains unchanged immediately after the event; however, circulating supply could drop to around 750 million (assuming that 1 $ONG = 1 $ONT) in the future due to the permanent lock mechanism.

Implementation Plan

- Adjust ONG Release Curve

- Cap total supply at 800 million ONG.

- Extend total release period from 18 to 19 years.

- Maintain a consistent 1 ONG per second release rate for the remaining years.

- Released ONG Allocation

- 80% of released ONG will continue to flow to governance as ONT staking incentives.

- 20%, plus transaction fees, will be contributed to ecological liquidity.

- Swap Mechanism

- ONG will be used to acquire ONT within a set fluctuation range.

- The acquired ONG and ONT will be paired to provide liquidity and generate LP tokens.

- LP tokens will be burned, permanently locking the underlying assets to maintain supply discipline.

Community Q&A Highlights

Q1. How long will the ONT + ONG (worth 100 million ONG) be locked?

It’s a permanent lock.

Q2. Why extend the release period if total ONG supply decreases?

Under the previous model, the release rate increased sharply in the final years. By keeping the release rate steady at 1 ONG per second, the new plan slightly extends the schedule — from 18 to roughly 19 years — while maintaining predictable emissions.

Q3. Will ONT staking APY be affected?

Rewards will shift slightly, with ONG emissions reduced by around 20%. However, as ONG becomes scarcer, its market value could rise, potentially offsetting or even improving overall APY.

Q4. What does this mean for the Ontology ecosystem?

With the total supply capped and 200 million ONG burned immediately, and 100 million $ONG equivalent-valued $ONG and $ONT permanently locked, effective circulating supply could drop to around 750 million (assuming that 1 $ONG = 1 $ONT). This scarcity, paired with ongoing ONG utility and swapping mechanisms, should strengthen market dynamics and improve long-term network health.

Q5. Who was eligible to vote?

All Triones nodes participated via OWallet, contributing to Ontology’s decentralized governance process.

The Vote at a Glance

| Proposal | ONG Tokenomics Adjustment |

|---|---|

| Voting Period | Oct 28–31, 2025 (UTC) |

| Vote Status | ✅ Approved |

| Total Votes in Favor | 117,169,804 |

| Votes Against | 0 |

| Status | Finished |

What Happens Next

With the proposal approved, the Ontology team will begin implementing the updated tokenomics plan according to the outlined schedule. The gradual rollout will ensure stability across the staking ecosystem and DEX liquidity pools as the new mechanisms are introduced.

This marks an important milestone in Ontology’s ongoing effort to evolve its token economy and strengthen decentralized governance.

As always, we thank our Triones nodes for participating and shaping the direction of the Ontology network.

Stay tuned for implementation updates and the next phase of Ontology’s roadmap.